Insider: A Free Report on Energy (With a Long-Term Recommendation)

Friday, I said I'd send you a report on Enterprise Product Partners (EPD). I'd love your feedback.

Dear Fellow Insider:

Republic Insider focuses on deep dives into CEO, CFO, and 10% Owner Buying at significant levels. We aim to provide actionable insight based on insider buying activity and deep analysis of companies worth your investment.

Sometimes, however, it’s not about the companies people buy.

It’s about the companies that executives aren’t selling.

So, today, I wanted to offer this free report to generate some awareness of our publication and the benefits we provide every month.

Today, we’ll dive into Enterprise Product Partners (EPD). In the world of publishing, there are always hiccups. Right now, I’m uncertain if I’ll be able to launch a letter I’ve proposed later this fall. And if that’s the case, I’m sitting on a large report we just finished. All the math would need to be updated, and we used a recent company presentation that will also be updated.

Why not give it to you as a bonus report… Because as a member of this insider letter, you’d receive a free year of whatever research service I create in the year ahead.

This report will likely undergo extensive edits in the future.

It’s largely a second draft, but it’s very timely. It also introduces me to the type of longer-form research I like.

So, without further ado, Meet Enterprise Product Partners (EPD)

All About Dan

Let’s dive into a saga where opportunity sprouted in the barren soil of the Great Depression.

The man behind EPD is Dan Duncan. He was a titan of the oil industry whose rise mirrors the resilience of Texas itself. Born in 1933, Duncan’s early life was marked by hardship, losing his mother to tuberculosis at the age of seven.

His refuge? The oil rigs.

There, he worked with his father until the latter’s death.

Then, he moved in with his grandmother.

Duncan's grit saw him through the Korean War and into the classrooms of Massey Business College in Houston. There, he studied accounting and business.

Duncan continued for years, digging into the riches of the Texas oil fields. He recognized that plenty of oil was coming out of the ground from these fields.

But just one problem existed: It all had to go somewhere.

So, in 1968, with a pocketful of dreams and a $10,000 loan from his sister, Duncan co-founded Enterprise Products Company.

Starting with two diesel trucks hauling NGLs, Duncan's foresight into this burgeoning market set the stage for his own “midstream” revolution.

Hands-on and relentless, he navigated fluctuating energy prices and regulatory upheavals, his instincts sharp as a hawk's.

Duncan’s genius lay in his vision for vertical integration.

He started snapping up pipelines and processing facilities, allowing Enterprise to control the flow from production to distribution—a full move through the U.S. energy supply chain.

This lifeblood strategy turned a modest transport outfit into a behemoth. By the late '70s, Duncan had the foresight to weave an extensive pipeline network, transforming Enterprise into a linchpin of the energy infrastructure sector.

Through the '80s, strategic acquisitions and an unyielding commitment to excellence saw Enterprise soar.

Duncan’s hands-on leadership—whether in the boardroom or the oil fields—ensured the company stayed agile and dominant.

The crowning glory came in 1998 with the birth of Enterprise Products Partners L.P.. This public entity unleashed a torrent of capital for expansion and solidified its supremacy in the midstream energy market.

Duncan passed away in 2010, but his legacy, forged in the crucible of hardship and honed by an indomitable spirit, continues to steer Enterprise Products Partners.

His strategic brilliance and unwavering dedication have entrenched the company as an industry leader, poised to capitalize on the roaring production boom in Texas and beyond.

To grasp why Enterprise stands as the colossus of this narrative, one must delve into the core value drivers that have steadily amplified shareholder value.

Driving Value Through an Extensive Pipeline

"Republic Value Drivers" are the pivotal elements propelling a company's ability to enhance profitability, growth potential, and overall market valuation.

In the case of Enterprise Products Partners (EPD), these drivers are deeply rooted in the company’s storied history and unique characteristics that strengthen customer relationships and maximize profitability.

At the heart of EPD’s success is its diverse asset base, which mitigates risks tied to any single commodity or market. Strategically positioned assets capitalize on regional supply and demand dynamics, creating a robust operational framework.

EPD’s integrated value chain—gathering, processing, transportation, and storage—ensures operational efficiency and multiple revenue streams. Long-term contracts provide stable, predictable cash flows, cushioning the company from commodity price volatility.

Financial discipline and a strong balance sheet allow prudent capital allocation and continuous investment in growth projects.

Operational excellence, marked by stringent safety and reliability standards, a favorable regulatory environment, and proactive stakeholder engagement, fortifies EPD’s market position.

Consistent distribution growth, driven by strong cash flow generation, makes EPD an attractive choice for income-focused investors. By honing in on these value drivers, EPD is poised to deliver sustainable growth and long-term value, maintaining its competitive edge in the midstream energy sector and inspiring investor confidence.

To fully appreciate this month’s recommendation, we will examine the core business elements that make Enterprise Products Partners a standout opportunity.

Strategic Position in the Energy Sector

A line we often quote, "There's Always Money in the Midstream," rings especially true today as midstream companies stand to benefit from the surging energy demand driven by the AI expansion of the domestic Data Center market.

Among the bustling arena of midstream operators, Enterprise Products Partners (EPD) emerges as our preferred MLP. EPD provides essential services for natural gas, NGLs, crude oil, refined products, and petrochemicals, managing over 50,000 miles of pipeline.

EPD focuses on investing in midstream energy infrastructure with attractive returns on capital, growing cash flow per unit, and maintaining long-term financial flexibility and balance sheet strength. Strategically positioned, EPD is poised to capitalize on the growing demand for energy infrastructure in the United States, which is crucial in transporting natural gas, crude oil, and refined products.

Source: EPD Investor Deck, May 2024

EPD’s infrastructure ensures the efficient movement of energy products from prolific production basins to key market centers and export facilities, vital for maintaining energy supply chains and enhancing national and global energy security.

The placement of EPD’s pipelines, storage facilities, and processing plants allows the company to serve major consumption markets and respond dynamically to shifts in supply and demand.

Source: EPD Investor Deck, May 2024

EPD boasts a vast and diversified portfolio of assets, including pipelines, storage facilities, and processing plants. This diversification is the company’s ace in the hole, reducing risk and enhancing cash flow stability by not overly reliant on any single energy market segment.

Enterprise Products Partners commands an extensive network of over 50,000 miles of pipelines. This infrastructure serves a broad spectrum of energy products, including natural gas, NGLs, crude oil, refined products, and petrochemicals. Here are a few highlights:

Over 20,000 miles of natural gas pipelines.

Twenty thousand miles of NGL pipelines.

Five thousand three hundred miles of crude oil pipelines.

Three thousand miles of refined product pipelines.

Sixty-three million barrels of crude oil storage – enough to cover three days of U.S. consumption.

Fourteen billion cubic feet of natural gas storage – good for two full days of U.S. consumption.

EPD is well-prepared to meet these needs as demand for energy infrastructure grows due to increased production, export opportunities, and technological advancements. Ongoing investments in expanding and upgrading its infrastructure network underscore EPD’s commitment to maintaining a leading role in the industry, setting the company up for sustainable growth.

A Diversified Asset Base

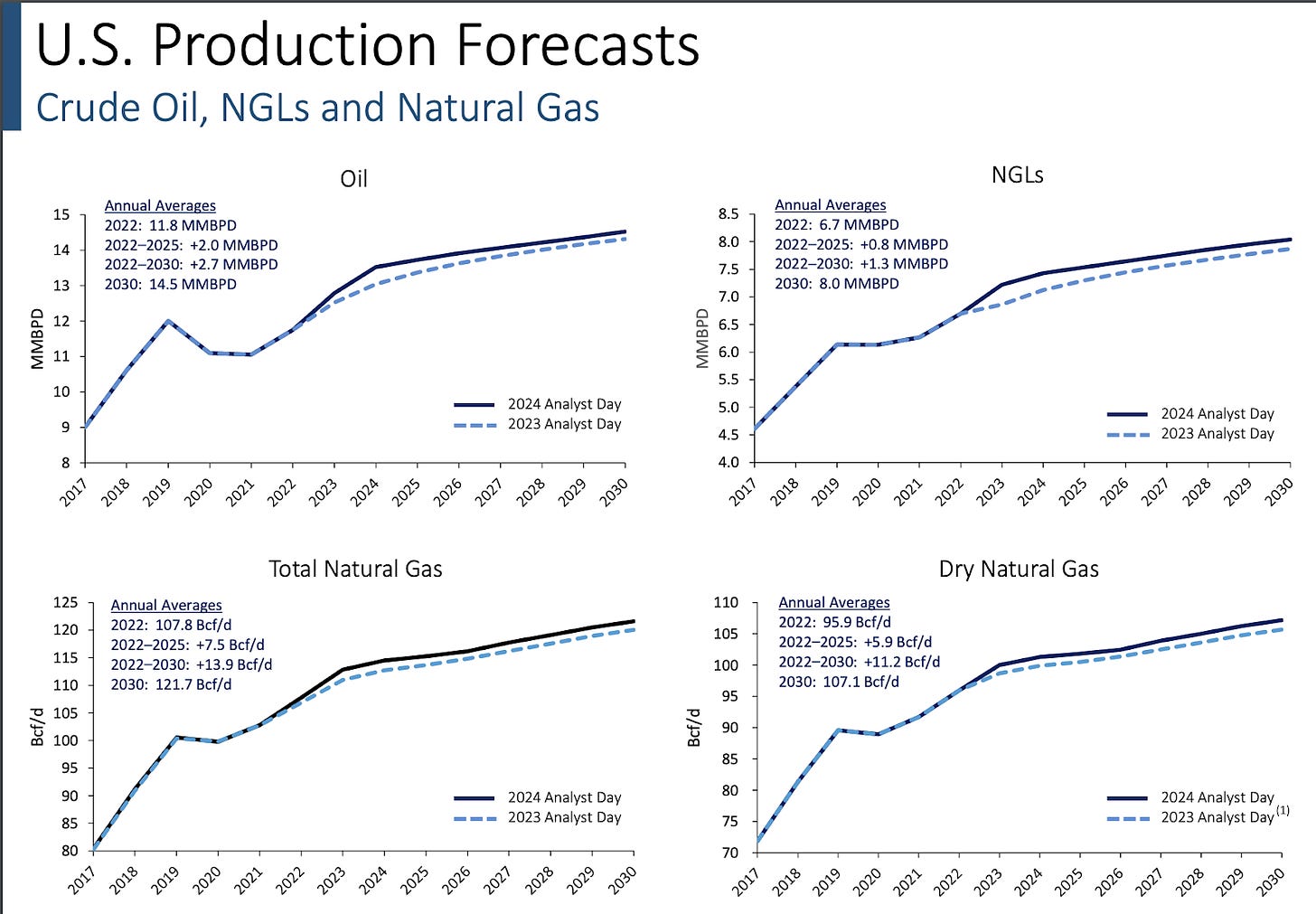

As U.S. energy production surges to new heights, Enterprise will be pivotal in transporting gas and oil across the country to storage facilities, refineries, and utilities. This ensures EPD's operations remain robust and adaptable.

The beauty of Enterprise Products' strategy lies in its diversification. If natural gas production dips, EPD’s extensive crude oil network picks up the slack, and vice versa. This operational diversity spans across the nation—from the Marcellus Shale in Pennsylvania and Ohio to the Permian Basin in Texas—ensuring resilience in the face of regional production fluctuations.

This multi-pronged approach grants EPD stable and reliable cash flows, fortifying its position in the midstream sector. Each segment buffers downturns in another, safeguarding the company’s financial health from sector-specific risks. This risk mitigation and robust operations position EPD as the shining star among midstream operators, our preferred MLP.

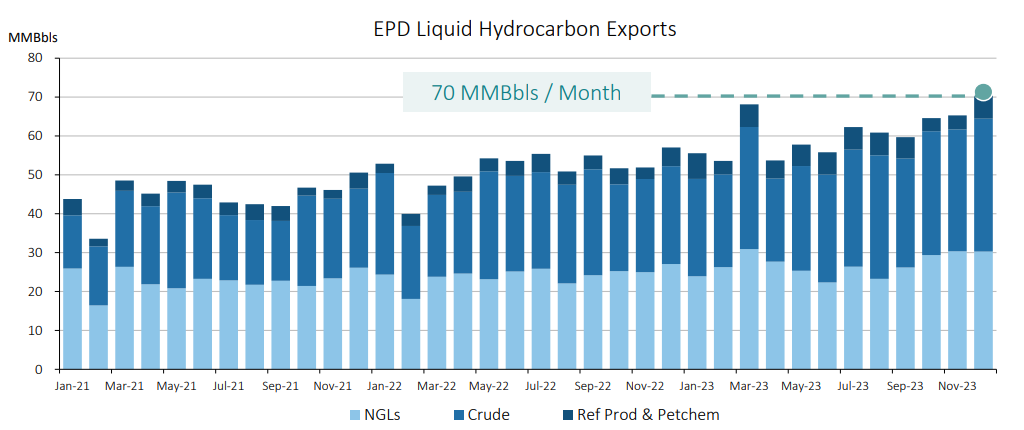

The chart below shows that the company has experienced record export volumes while never relying on one fuel to dominate its portfolio. Last December, the company was responsible for a record 70 million barrels of fuel monthly.

Source: EPD Investor Deck, May 2024

Growth Prospects Through Expansion Projects:

EPD has a robust pipeline of expansion projects to increase capacity and enhance its service offerings. These projects are expected to drive future growth and profitability, ensuring long-term value creation for shareholders.

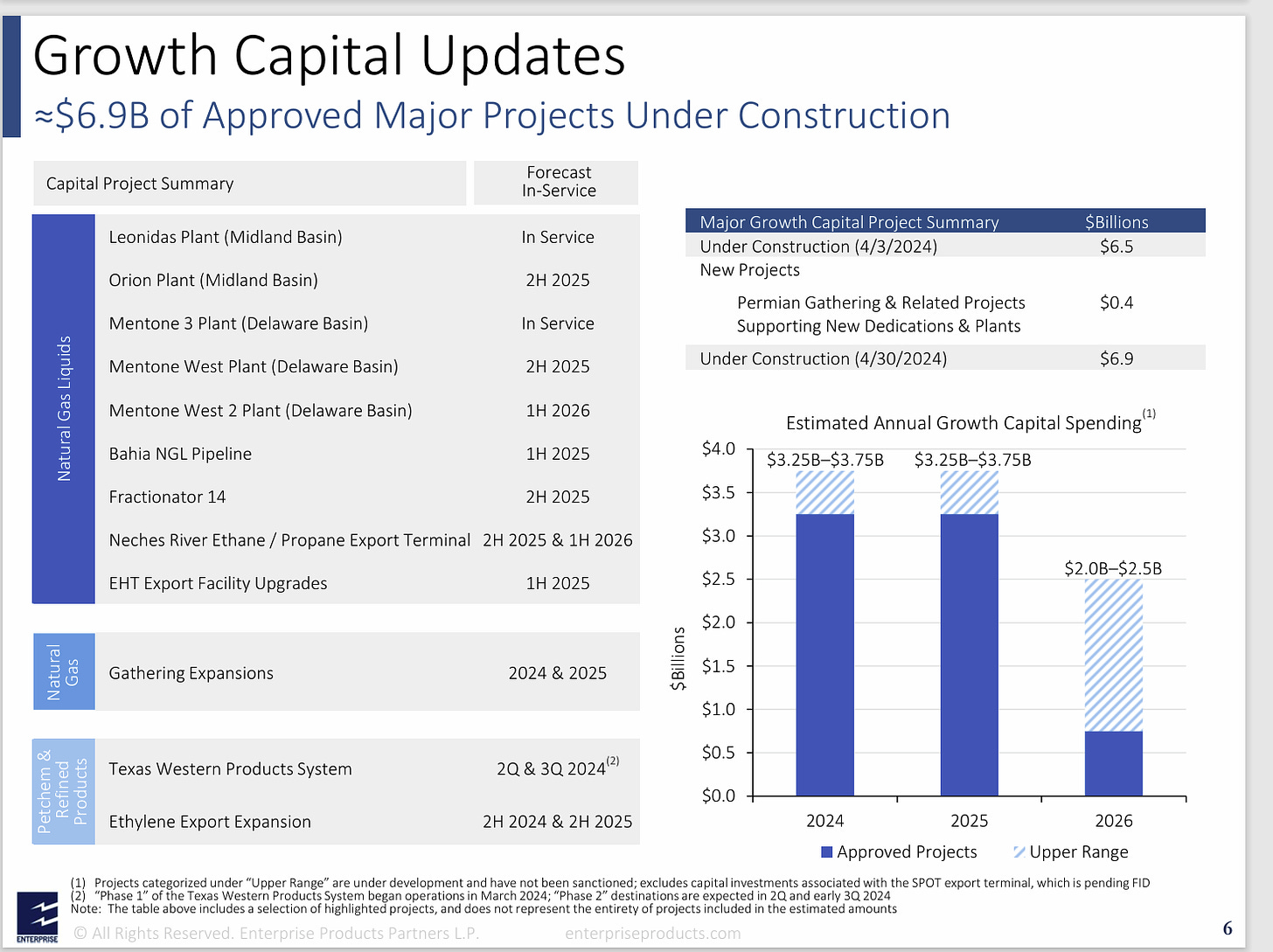

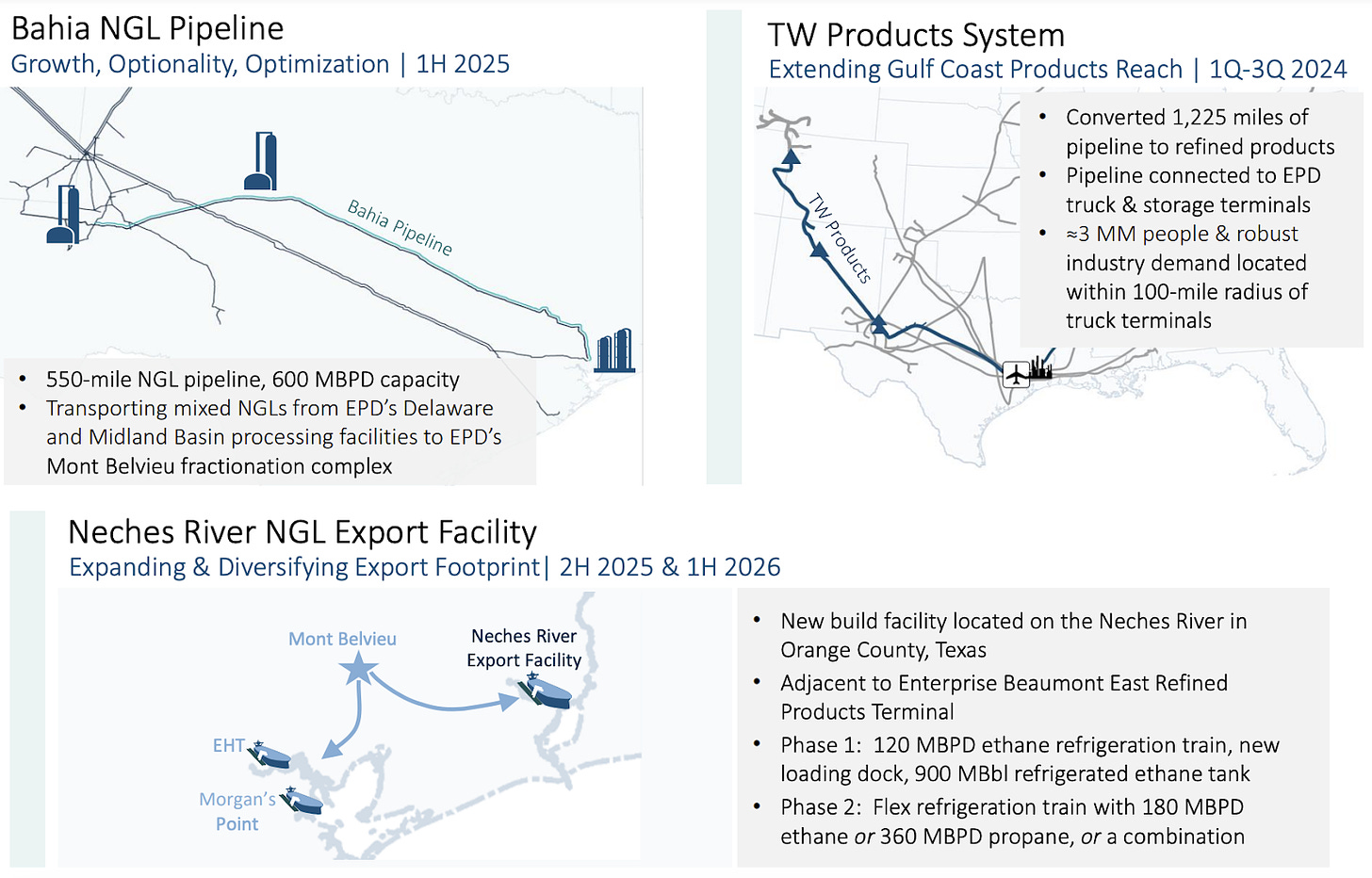

EPD is entering a significant growth phase. It increased its capital expenditures to $3.5 billion last year and plans to spend nearly $7 billion more through 2025.

Key projects include new natural gas processing plants and NGL pipelines in the Permian Basin, such as the Mentone 4 plant, set to process over 300 million cubic feet per day of natural gas.

Additionally, the recently licensed Sea Port Oil Terminal (SPOT) project will load 2 million barrels of crude oil daily, boosting EPD's export capabilities and positioning the company for robust future returns.

Source: Enterprise Products Partners First Quarter 2024

In addition to the new and existing projects under construction, EPD recently enhanced its portfolio by acquiring key assets from Occidental Petroleum for $400 million.

The deal includes a 20% interest in the Whitethorn crude oil pipeline and a 25% stake in two NGL fractionators in Mont Belvieu, Texas, significantly bolstering capacity and efficiency in the Permian Basin.

Following its acquisition of Anadarko Petroleum in 2019, Occidental wanted to streamline operations and reduce debt. This divestment allows Occidental to focus on its core activities and improve its bottom line.

The acquisition supports EPD's growth strategy in high-output areas like the Permian Basin. The Whitethorn pipeline and Mont Belvieu fractionators are vital for moving oil and gas, further enhancing EPD's long-term profitability.

Source: EPD Investor Deck, May 2024

Moving forward, the question is whether this deal marks the end of EPD's acquisitions of Occidental's Western Midstream assets or just the beginning.

Given Western Midstream's portfolio and Occidental's intention to clean up the balance sheet, further transactions seem likely.

Resilience to Market Volatility and Customer Relationships

EPD's fee-based revenue model ensures a significant portion of its income is stable and less susceptible to market fluctuations. As a midstream operator, EPD acts like a toll-bridge operator, accepting fees for the right to cross over the structure. The same goes for their pipelines. This resilience is critical during economic uncertainty or volatile energy prices, providing a buffer against downturns.

source: EPD Investor Deck, May 2024

According to Bloomberg, the company maintains long-term relationships with a large, diverse base of the energy market's most prominent producers, including MRC Global, Matador Resources, Evolution Petroleum, Phillips 66, and Enbridge.

Experienced Management Team

EPD operates under the stewardship of a strong leadership group, each member a veritable titan in their own right. Here are the profiles of key leaders at the firm.

Source: enterpriseproducts.com

Jim Teague (Co-CEO): Since 1999, Jim Teague has held various leadership roles with Enterprise Products. Elevated to CEO in 2016 and later Co-CEO in 2020, Teague has deftly orchestrated the company’s meteoric rise through shrewd acquisitions and organic expansions. Teague's journey in the energy sector spans decades. Before joining Enterprise, he built a formidable career at Dow Chemical Company, working from 1972 to 1996. During his 24 years at Dow, Teague held various roles, ultimately serving as Vice President of Hydrocarbon Feedstocks. He managed the supply and logistics of critical raw materials, honing his skills in global market navigation and strategic resource management. His analytical prowess and strategic acumen at Dow set him up for what would come next.

Following Dow, Teague served as President of Marketing and Trading at MAPCO, Inc., before becoming President of Tejas Natural Gas Liquids, LLC, an affiliate of Shell. Teague joined Enterprise following the acquisition of Shell’s midstream business.

Beyond his industry roles, Teague has been actively involved with the Jones Graduate School of Business at Rice University, contributing to the academic community and supporting the development of future business leaders.

Additionally, Teague has considerable skin in the game, owning over 3.5 million shares of EPD, which, at $30 per share, totals more than $105 million, making him the largest individual shareholder behind the Duncan family.

At Enterprise, Teague's deep industry knowledge and strategic vision have propelled EPD to become a powerhouse in the midstream energy sector. His efforts have been pivotal in transforming Enterprise from a $1.5 billion entity to a midstream powerhouse valued at approximately $93 billion today.

Randall Fowler (Co-CEO): Randall Fowler has been a linchpin of Enterprise Products since 1999. Ascending to CFO in 2007 and Co-CEO in 2020, Fowler's fiscal acumen and strategic oversight have been instrumental in fortifying the company's balance sheet, securing vital funding, and ensuring a regimen of financial discipline.

Under his guidance, EPD's financial health has flourished, with consistent distribution growth as its hallmark.

Before joining Enterprise, Fowler held significant roles in the energy sector, including Vice President and Treasurer at NorAm Energy Corp., which was acquired by Houston Industries, enhancing its market position. At Reliant Energy, he helped lead its transition from a regulated utility to a competitive energy company. His strategic leadership contributed to Reliant's success and its eventual acquisition by NRG Energy.

With a Bachelor of Science in accounting and an MBA from Louisiana Tech University, Fowler's educational background provided a solid foundation for his career.

His professional involvement extends beyond Enterprise. He serves as Chairman of the Board of the Energy Infrastructure Council (EIC), an organization that represents the interests of companies involved in the energy infrastructure sector and advocates for policies that support investment and development in energy infrastructure.

Fowler has also built up a considerable stake in the company, owning 2,877,320 shares valued at over $85 million.

Graham Bacon (COO): A veteran with over three decades of EPD operations experience, Graham Bacon has been with Enterprise Products since 1991. As Chief Operating Officer, he oversees the company’s vast network of pipelines, storage facilities, and processing plants, focusing on operational efficiency and safety.

He brings a disciplined approach, honed during his service as an officer in the U.S. Naval Reserve, to his role at Enterprise. Bacon's academic credentials include a degree in Chemical Engineering from Texas A&M University and an MBA from Oklahoma City University.

R. Daniel Boss (CFO): Richard Daniel Boss has been a pivotal force at Enterprise Products since 2008. His journey within the company has seen him rise to Executive Vice President and Chief Financial Officer in March 2024.

Before stepping into his current role, Boss served as Executive Vice President of Accounting, Risk Control, and Information Technology from January 2020 to February. His responsibilities included managing financial reporting, handling regulated business operations, and overseeing compliance with rigorous risk management frameworks. Before joining Enterprise Boss, he held leadership positions at Merrill Lynch Commodities and Dynegy Inc., where he honed his skills in commodity trading, risk management, and financial controls. Boss has a strong foundation in financial management and is a Certified Public Accountant (CPA).

Christian M. Nelly (Executive Vice President, Finance, Sustainability, and Treasurer): Christian M. Nelly has been a cornerstone at Enterprise Products since 2008. Elevated to Executive Vice President of Finance and Sustainability and Treasurer in July 2020, Nelly has played a crucial role in steering the company's financing activities, business planning, credit and cash management, corporate risk and insurance, investor relations, sustainability, and public relations. His strategic vision ensures the company’s financial health and commitment to environmental goals.

Before this role, Nelly held various senior positions within Enterprise, including Executive Vice President of Finance and Treasurer. He also spent a decade in corporate and investment banking, executing transactions and managing relationships with midstream and upstream energy companies.

Nelly received a Bachelor of Business Administration in Finance from the Hankamer School of Business at Baylor University. His expertise in strategic advisory, valuation, mergers and acquisitions, and capital raising helps drive Enterprise's growth and sustainability initiatives.

Brent Secrest (EVP, Chief Commercial Officer) Brent Secrest’s extensive career in the energy industry began at Enterprise Products in 1996, where he initially served as a Senior Analyst in Business Management. After a stint at Calpine Merchant Services Corp. from 1999 to 2006 as Manager in Producer Services, he returned to Enterprise. He ascended through various leadership roles, including Director of Commercial Development, Regional Director, and Vice President of multiple divisions. In September 2019, he was appointed Chief Commercial Officer, where he now oversees the company’s commercial strategies, driving growth and operational efficiency across its vast midstream infrastructure.

Secrest holds a BBA in Finance from Middle Tennessee State University, providing him with a solid foundation in business and finance. His leadership and strategic vision have been instrumental in maintaining Enterprise Products' strong market position and operational excellence. Secrest’s deep understanding of commercial operations and his broad experience within the company continue to propel Enterprise’s growth and profitability, making him a vital asset to the leadership team.

Talking Finances

EPD isn’t just riding the wave of growing U.S. energy production; it’s steered by a stellar management team and fortified by solid financials.

EPD stands tall with a robust balance sheet and prudent financial management. The company’s investment-grade credit rating and conservative leverage ratios testify to its financial flexibility, ensuring a lower cost of capital and bolstering investor confidence.

In the past year alone, EPD raked in $52 billion in revenue, with $9.1 billion translating to EBITDA and $5.6 billion trickling down to net income.

The pipeline business, renowned for its capital efficiency, sees EPD's major expenditures focused on maintaining and expanding its extensive network. With $3.6 billion in capital expenditures over the last 12 months, EPD continues strengthening its infrastructure.

Its $29 billion debt might seem hefty for a $63 billion company. Still, with a net income that comfortably covers its $1.2 billion interest expense, EPD’s financial health is solid. Remarkably, EPD has reduced its debt by about $1.5 billion since 2020 while growing distributions to investors for 25 consecutive years. No wonder EPD boasts the highest credit rating in the midstream sector, solidly nestled in the investment-grade category by all three major credit agencies.

EPD masterfully manages its leverage, maintaining a ratio of 3.0x within its target range of 2.75–3.25x. This careful balance allows EPD to handle its debt obligations effectively while staying flexible enough to seize growth opportunities.

Maintaining such a disciplined leverage ratio is crucial in the energy sector, where capital-intensive projects and market volatility are common. EPD mitigates risks by keeping leverage in check and supporting its long-term financial health, ensuring it can navigate downturns and invest in future growth without compromising financial stability.

Strength Over Competition

EPD isn't the only player in the midstream arena; it competes with giants like Kinder Morgan (KMI), Williams Companies (WMB), Enbridge (ENB), and Energy Transfer (ET).

But why does EPD stand out? Let’s delve into some key metrics:

All of these companies stand to benefit from increased U.S. energy production. So why do we like Enterprise Products more than these other companies?

We will examine two valuation metrics (EV/EBITDA and P/FCF) and two profitability metrics (return on equity and return on assets). Here’s how they compare:

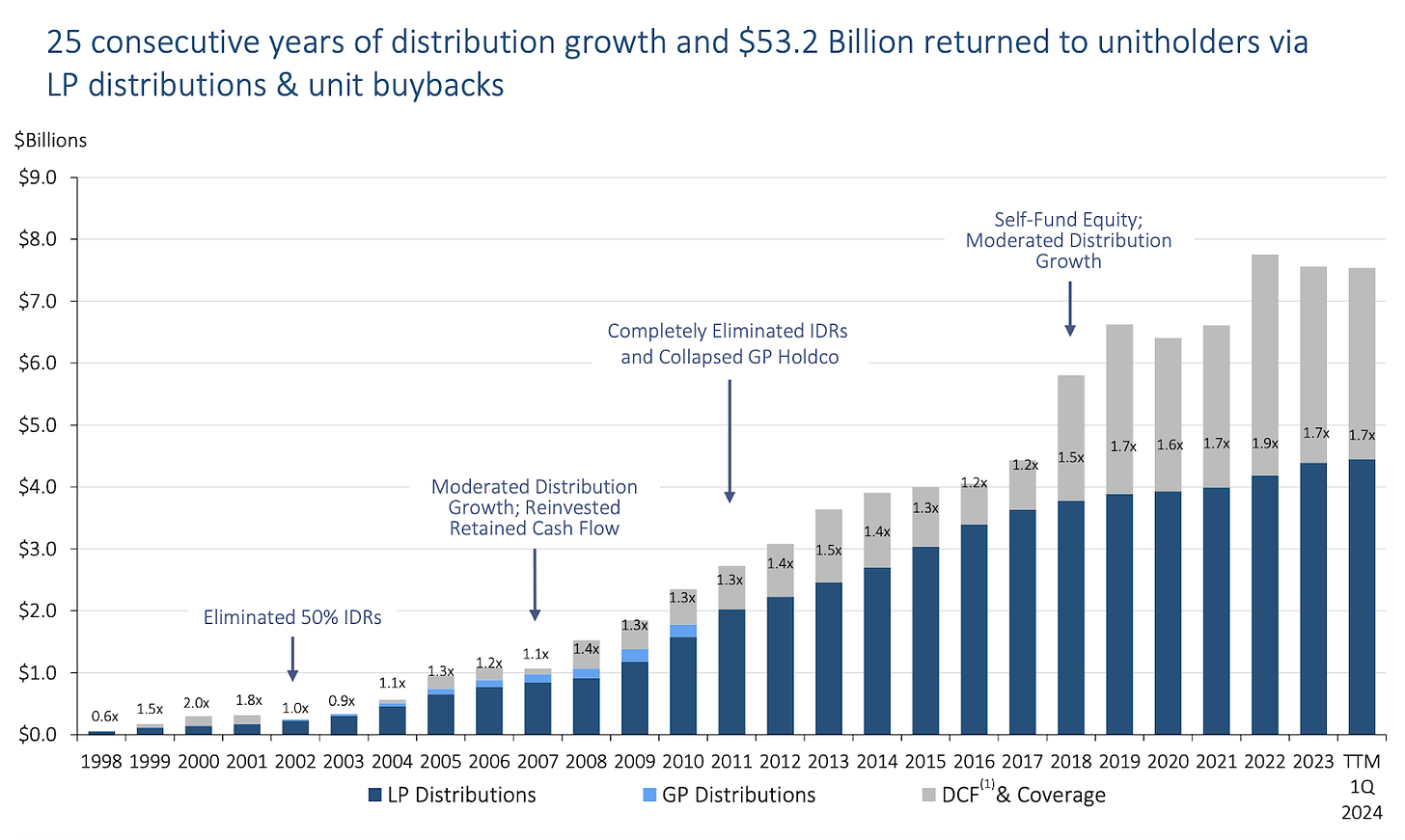

EPD outperforms its peers in profitability metrics, blowing them out of the water with superior return on equity (ROE) and return on assets (ROA). Its dividend yield of 7.1% exceeds the group average, making it a darling for income-focused investors. As a newly minted Dividend Aristocrat, having increased its payouts for 25 consecutive years, EPD is set to keep raising distributions, further rewarding its shareholders.

Additionally, EPD is dedicated to responsibly returning capital to investors, maintaining double-digit returns even in financial crises. This highlights the importance of Return on Invested Capital (ROIC) as a critical efficiency measure.

Source: EPD Investor Deck, May 2024

A strong ROIC indicates effective capital use to generate profits, emphasizing EPD's skill in managing and allocating resources for sustainable financial health. A double-digit Return on Investment is at the top of our list of requirements before considering a long-term position and is another key value driver for EPD.

Stable and Attractive Dividend Yield

Enterprise Product Partners has a history of providing stable and high dividend yields, often outperforming many of its peers in the midstream energy sector. This reliability in dividend payouts appeals to income-focused investors looking for consistent returns.

EPD is a Dividend Aristocrat. It has increased its payouts to investors for 25 consecutive years, distributing $53.2 billion through limited partner distributions and common unit repurchases. The company holds an A rating with S&P and offers a dividend yield of 7%, placing it in a league of its own.

Source: EPD Investor Deck, May 2024

What’s more. Industry analysts anticipate the company’s cash flow will remain highly stable in the decade ahead. An analysis of Bloomberg reveals expectations that the company will continue to increase its quarterly dividend of $0.525 (paid in July 2024) to as much as $0.75 by 2031. This would represent an annual dividend increase of $2.08 (6.93%) to $3.00 per year. Should that dividend manifest and maintain its current yield, this would represent a share price of $42.85, not including the ample dividends available through dividend reinvestment and stock buybacks.

And as you’re about to see, EPD has shattered the total return of the S&P 500 and the broader energy sector for decades. On a total return basis, including dividends, capital gains, and any interest received, EPD has significantly outpaced SPX and XLE, delivering six times the gains with a total return of 4000% since 1998.

Source: Bloomberg, EPD Investor Deck, May 2024

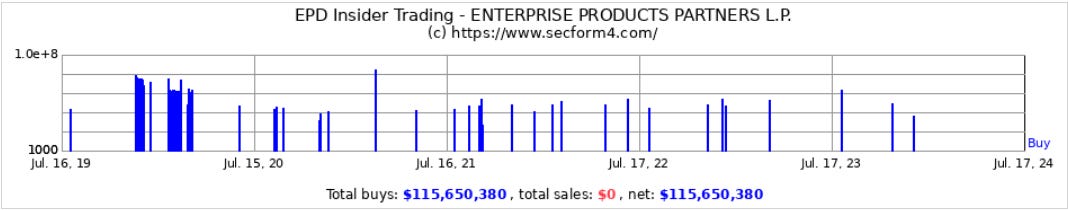

Adding to EPD’s impressive credentials, the company has not experienced an insider stock sale in over five years. During this time, executives, directors, and major shareholders have collectively purchased $115 million worth of company stock.

Peter Lynch famously said, "Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

Source: secform4.com

You are looking at this chart correctly. Executives have not sold any of their stock in the last five years, even in the face of COVID-19, liquidity shocks, and concerns about the broader U.S. economy.

There’s a reason for this…

Demand Is Coming

As the U.S. and China compete for economic power, both countries increasingly use artificial intelligence (AI) to tackle domestic and international challenges. This growing reliance on AI is changing the energy demand, especially as data centers, which are essential for AI, use more power.

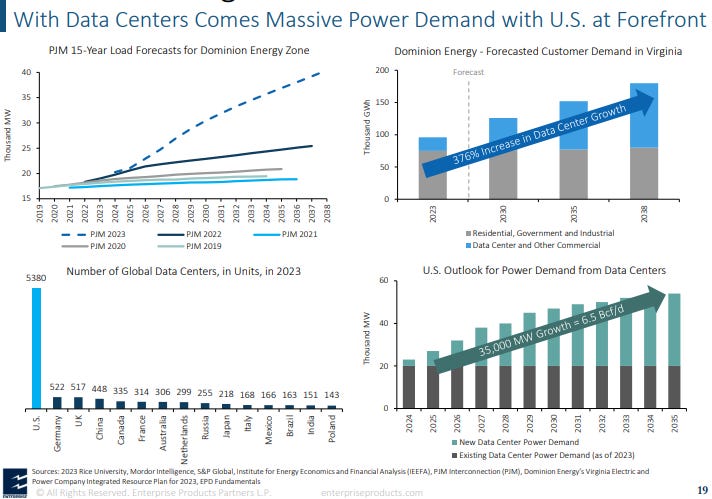

According to Dominion Energy, the energy demand from data centers in Virginia alone is expected to grow by 376% over the next 15 years. This is part of a larger rapid growth trend in U.S. data centers. A chart shows that the U.S. has far more data center facilities than any other country, with ten times more than Germany, our closest competitor.

source: EPD Investor Deck, May 2024

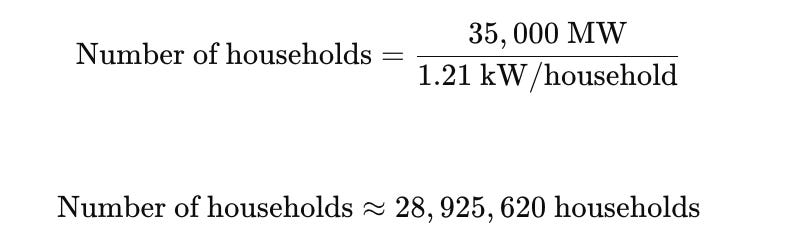

Finally, consider pipeline giant Enterprise Product Partners's new data center demand outlook. The bottom right chart showcases the expected demand for these data centers from 2024 to 2035. This forecasts roughly 35,000 MW of growth required to meet data center demand alone in the next 11 years. At a constant of 1.21 KW per household, an electricity supply is enough to power 28.9 million households.

This growing demand for AI capabilities directly leads to more data processing, significantly increasing the electricity these data centers consume. Estimates from the International Energy Agency (IEA) suggest that electricity use by data centers could double by 2026. This is both a challenge and an opportunity for the U.S. energy sector, pushing operators to increase production across all types of energy, from fossil fuels to renewables, to meet these growing needs.

source: IEA Electricity 2024, Jan 2024

As AI becomes more integrated into various sectors, there is a rising demand for robust and reliable energy supply chains, especially for natural gas production. The U.S. is advancing its resource extraction technologies and accelerating the deployment of renewable energy sources like geothermal and solar. These efforts support the significant infrastructure needed for AI development and use.

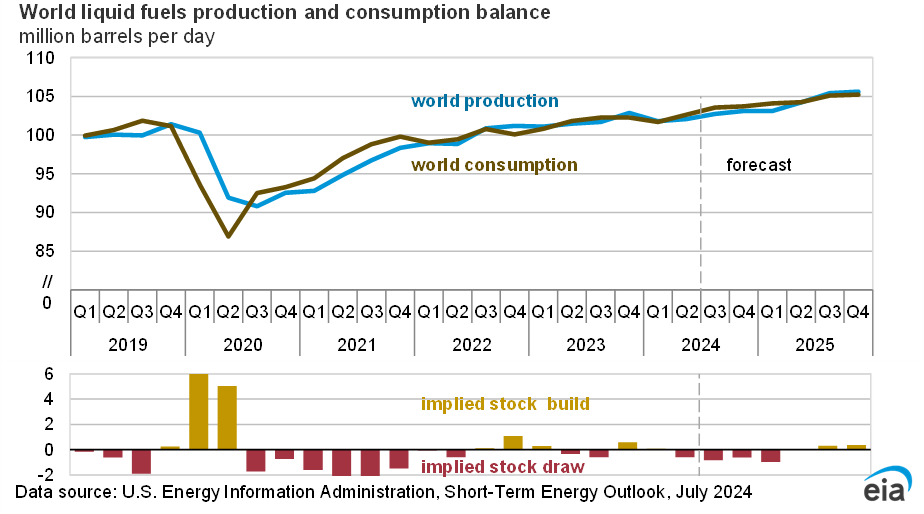

source: EIA, Short-Term Energy Outlook, July 2024

The rise of AI has sparked a lot of investment and demand throughout the energy value chain.

The energy sector is quickly adapting, from increasing extraction rates and optimizing resource recovery at the source to improving logistics and storage solutions along transportation routes. Refining techniques and distribution strategies are also evolving to meet the quick-paced demand driven by AI and other high-tech uses, leading to technological advancements that strengthen and secure the energy industry.

Conclusion

The global oil market points to increased global production and demand in this decade and over the next 30 years. Even in scenarios where the world reduces its carbon footprint, according to the Energy Information Administration, the research arm of the Department of Energy, only coal becomes the source of hydrocarbon production that decreases.

Given the world’s struggles to transition from oil and gas, gasoline (an oil byproduct) will remain the dominant transportation fuel for the coming decades. Meanwhile, as solar, wind, and other intermittent energy sources create reliability issues, natural gas (half the carbon footprint of coal) will emerge as the dominant bridge fuel until future generations identify more robust and reliable sources.

Thanks to men like Dan Duncan, America’s energy future is brighter than ever, with less reliance on foreign fuels, a robust economic and job development source, and leading technological innovation that will make U.S. engineering the world's envy.

But the new problem it creates is our payday - the fact that the U.S. will need to move roughly 14 million barrels per day - largely out of the Permian Basin - is a dream for midstream investors.

Remember, there is Always Money in the Midstream…

And your ticket starts with a long-term investment in Enterprise Product Partners.

Recommendation: Buy and Hold Enterprise Product Partners (EPD) at market price. It is a cornerstone portfolio addition.

Now an even prouder Texan! Rice University is brutal.

Thank you Garrett, great insights on a stock I've held for awhile - I'd better buy some more! A great balance betwenn narrative and numbers, your forte. I thought the CV's of the management team were a bit long and looking a tad cut and pasty? The gem was the insider no sell for 5 years insight. Thank you for sharing :)